How to Appeal Your Property Taxes

Below are 10 Steps to REDUCE your Tax Bill. It is well known the property tax system is broken. In the meantime, here is How to Appeal Your Property Taxes.

1) File an online appeal here. This will schedule your appointment with the Board of Assessors. It will be some time before you hear back from them

1a) Contact County Appraiser, Dwight Robinson and request the comps they are using for your assessment.

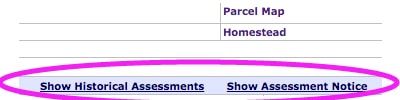

2) Review your Property Records to ensure it is accurate, (fireplaces, beds, bathrooms, sq ft, etc)

3) Check for homestead deductions (homeowners & mostly for seniors)

4) Research recent sales in the Property Records of your neighborhood to find comparable homes

5) Review property assessments with the public records for comparables

6) Create a spreadsheet of comparables (3-5 Properties), and breakdown each property

7) Take pictures of the comparable homes

8) Set a reasonable value amount for your property

9) Prepare presentation: Create an easy to read packet to bring to your hearing

Front page - Picture of your house & the value "think" it is worth

Second Page - Spreadsheet with the breakdown of comparables

Next 5 pages - Pictures and info of each comparable property

Optional info:

Include pictures of the inside of your house, if it's not upgraded

Pictures & details of backyard if it is sloped or devalued in some way

10) Attend your scheduled Hearing

Have 7 packet copies to pass out to each board member!

Be non-emotional and factual during the hearing

Present the data in a calm, logical manner.

Good Luck!

--Be sure

Be sure to share and bookmark this post as a reference.

Neighbors, do you have any tips or suggestions?

I went through the appeal process last year, did all the steps listed above, PLUS got an appraisal. Appraisal really helped.Assessor added bedroom, a lot of sq feet, finished basement (all not existing) and almost doubled my value. I won the appeal, but had to wait until last month to finally get a little money refunded. Told me I would not have have go up for next 3 years after all the time & expense of appeal last year. Surprise!!! This year the again revalued home with extra bedrooms, sq feet, etc and added several hundreds of thousands back on my valuation. They said I had to appeal, AGAIN. Called state representative, no help. For 25 years the value changed very little. I feel like the are going after us retirees, it is so unfair to make me prove every year they greatly over-valued my home. Good Luck, do suggest getting a appraisal if you can afford it.

Select recent sales that are within five years of your build date. this will remove new homes and usually more expensive homes from your selection. I also picked homes on slab, then lot size, and without basement or attic. Just some ideas. Usually this gets the list down to 4 or five houses.

While increasing property values may or may not be disputed, what cannot be disputed is continued government overreach and excess taxation without accountability and representation. A water & sewer tax increase was foisted on us a few years back with the drought. Last year, under the guise of "fairness" - a political favorite, gas taxes were raised and an internet state sales tax was added to your online purchases and user fees to cell phone and cable bills. Has there been any measurable betterment in traffic? Sure, we have more police issuing tickets and fancy new trucks. There is no limit to the governments willingness to tax everything and anything ad nausea with no reprieve.

I'm glad the gas tax increases happened. I was hoping for a much larger increase. Georgia is backed logged on road projects. It will take decades to build out our infrastructure. I didn't expect a six cent a gallon gas tax increase to magically fix traffic in one year. Gas tax is totally manageable. You can control to some degree how much fuel you purchase (carpooling, moving closer to work, buying a more efficient car, etc...)

Stock market has over tripled in eight years. Those who are fiscally conservative and invest properly and live below their means should not care over trivial gas taxes that are badly needed for infrastructure improvements considering how real estate rates are low and housing and stock market is soaring.

My taxes went up 43%!

Definitely need to do an appeal.

Thank you JCP!

Are you sure your taxes went up 43% or your assessment went up that much. Millage rates have yet to be finalized which is what will determine your tax bill.

My estimated taxes went up 41%. The assessment went up over 32%. My homestead exemption went down...is that the way it's supposed to work?