Arthur Ferdinand Pays Little Taxes! When comparing his surrounding properties, Fulton County Tax Commissioner Arthur Ferdinand Pays Little Taxes. It bears repeating.

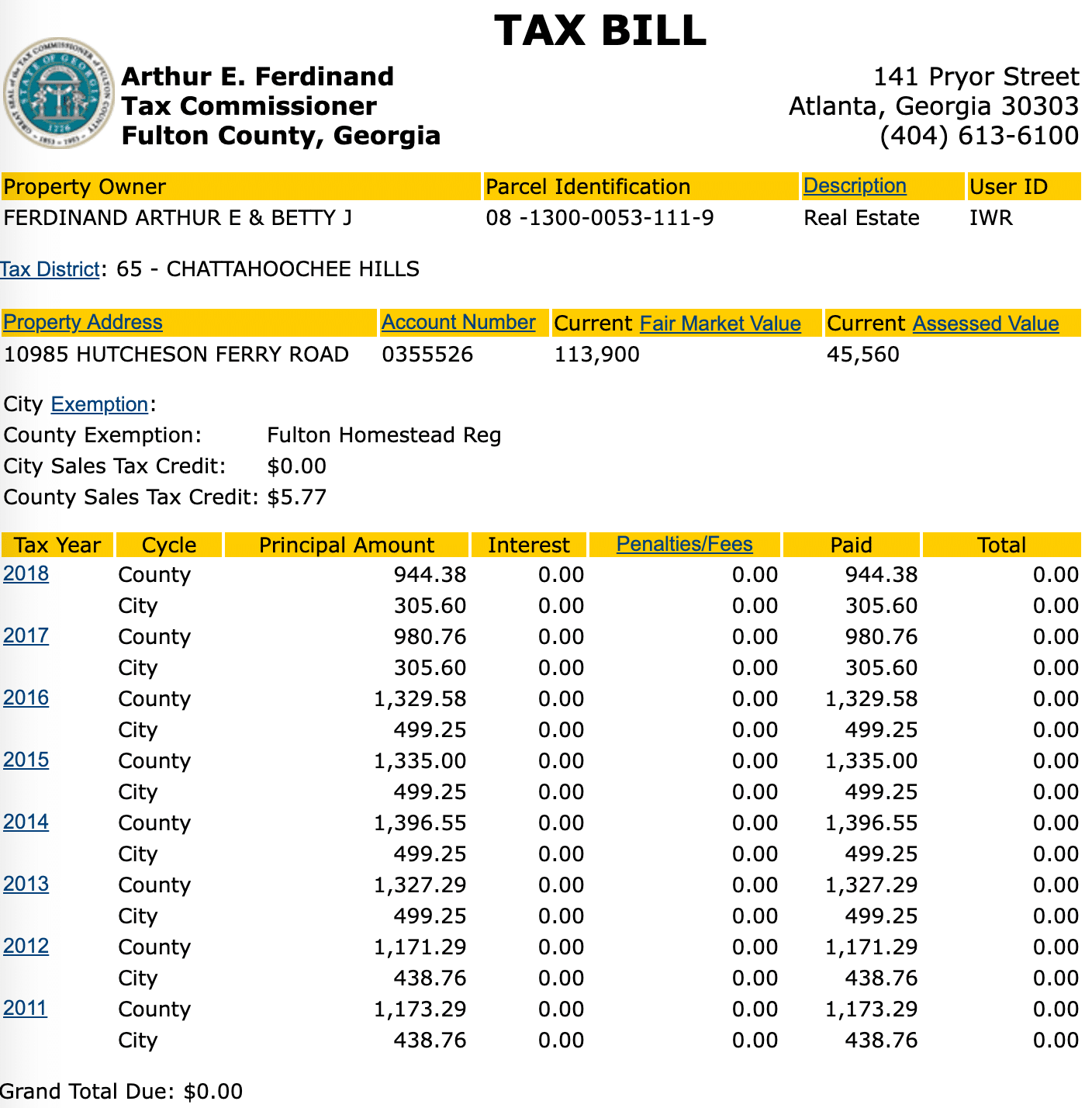

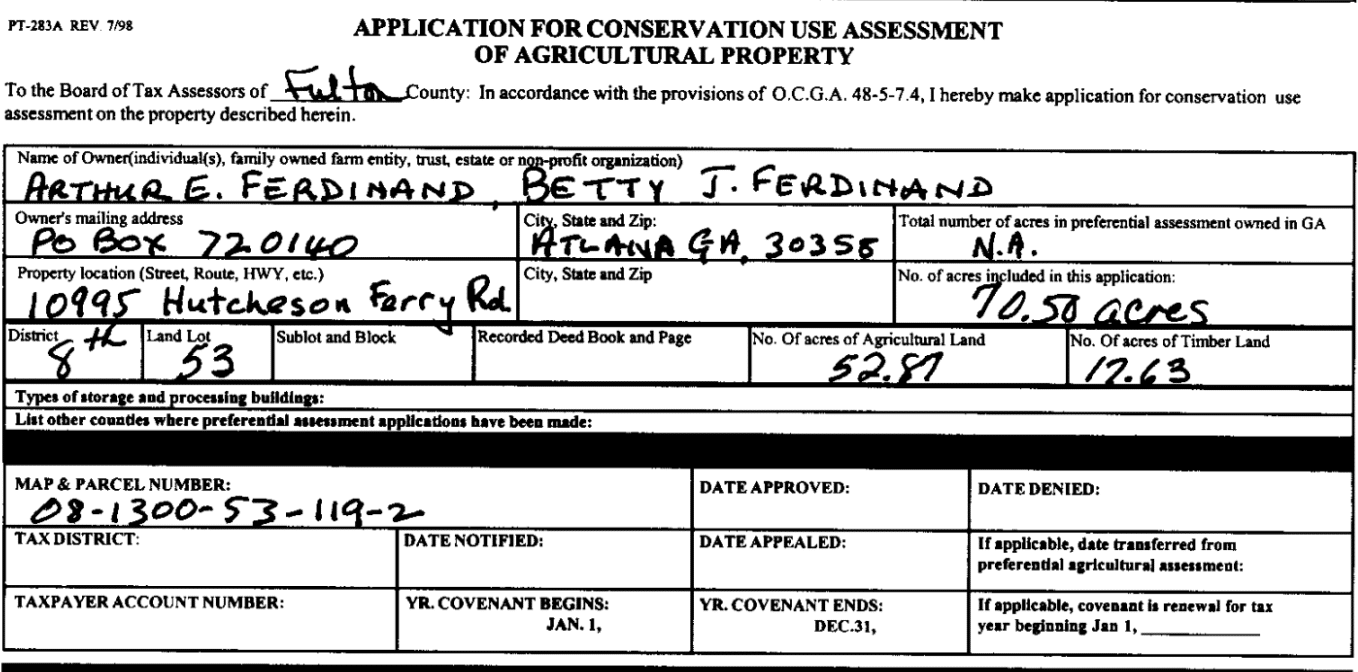

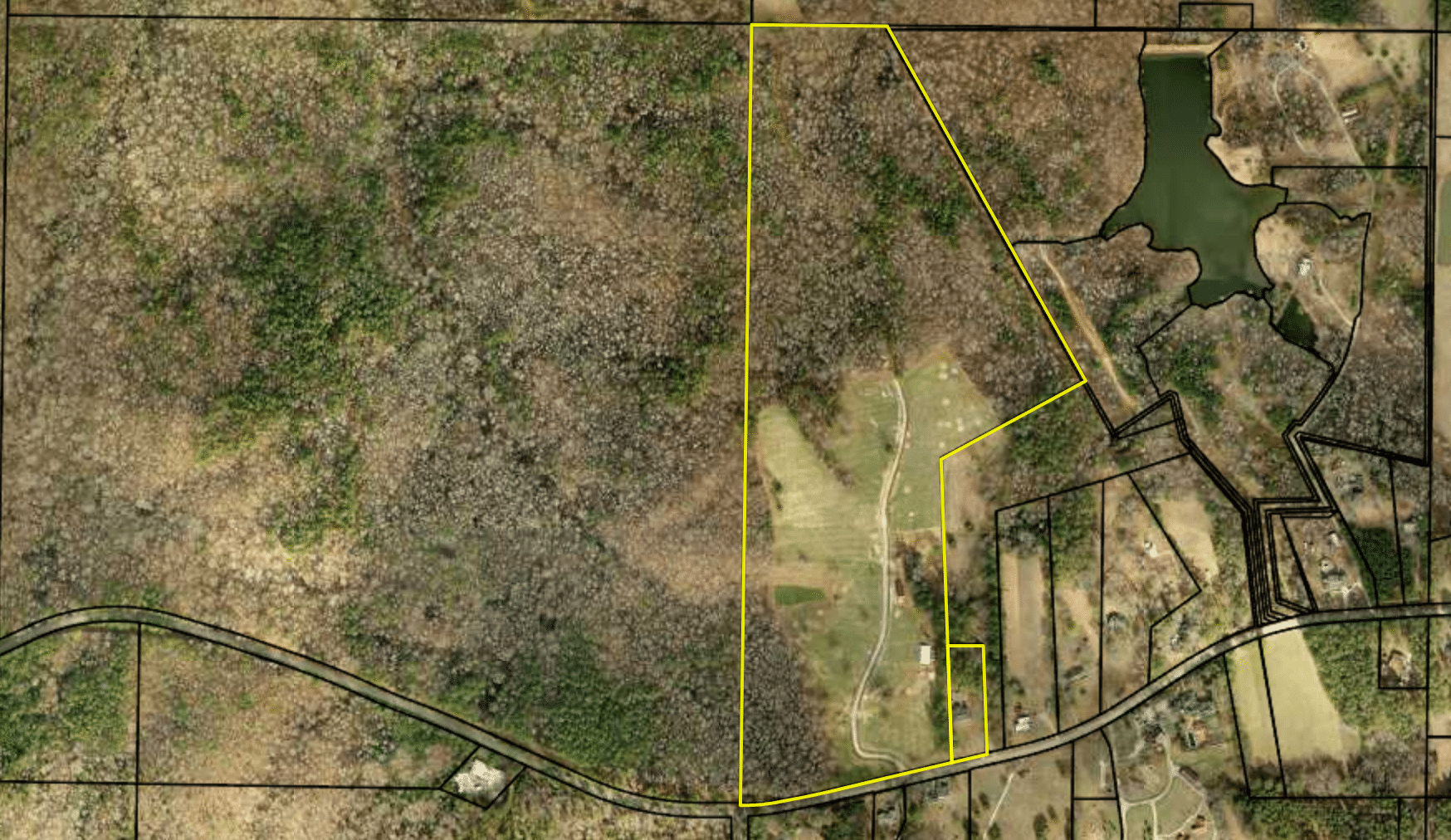

According to public records, Arthur & Betty Ferdinand have a house and 69 acres. Split into 2 parcels for tax purposes. The house property class is a residential lot on 1.6 acres. The other parcel is 67 acres. Located in Chattahoochee Hills, in the most southern part of Fulton County. Records indicate the land was deemed to be "conserved" and is to remain undeveloped in return for favorable tax treatment. Very favorable when you look at the details.

In 2018, the Ferdinand's paid a total property tax for both parcels: $2380.32.

Below is Ferdinand's Application for the Conservation Use. Has the property changed, or are there some discrepancies between the documents?

The Reduced Taxes are given when the land is devoted to producing agricultural and timber products.

What is interesting, is Ferdinand claimed "Other Exempt" for a hefty $147K.

Even with the conservation easement, the Ferdinands pay considerably fewer taxes than their neighbors. The assessment notices for the smaller parcels to the right, are below.

This adjacent property is 3x larger than the Ferdinand's. It is listed as a "Vacant Parcel". It was assessed for $16,016.72. Public Records indicate on the Tax Bill, $11,850.06 was paid for the year 2018.

In other words, the land is 3x the size, and they paid 10x the amount of taxes compared to Ferdinand's!

Likewise, there are many ongoing issues regarding assessments. These are just few parcels near the Fulton County Tax Commissioner properties.

In conclusion, there is a lot of disparity in taxes. These discrepancies and serious issues are throughout the County regarding valuation, assessment and taxation. Have a Look at some records yourself here: Fulton County Property Taxes.

Here is a post about how you can appeal your property taxes.

Source: Fulton County Property Records

We found a second Tax Bill, under another account number. This is for Ferdinand's Residential parcel of 1.6 acres.

He paid $1249.98 property taxes in 2018 for the house.

This brings the total property taxes for 69 acres and house to $2380.32.